Not too long ago, Wall Street had a serious crush on weight-loss drug makers, with excitement soaring as high as it did for companies dabbling in artificial intelligence. But that infatuation faded, especially for Novo Nordisk (NVO), the company behind the breakthrough GLP-1 receptor agonists used for treating type 2 diabetes and obesity. Recent events have turned the love affair into a rollercoaster ride, with stock values plummeting. However, savvy investors might just find this dip is a golden opportunity to buy.

Novo’s Stock Performance

Since the end of June, Novo Nordisk has seen its stock tumble by about 25%. This decline began when the company announced plans to invest around $4 billion to ramp up manufacturing capabilities in the U.S., aiming to meet the surging demand for its popular drugs, Wegovy and Ozempic. This ambitious move, however, came with a caveat: Novo’s profit outlook didn’t meet the lofty expectations that Wall Street had set, leading to a decline in sentiment.

Despite the recent downturn, it’s important to note that Novo’s stock has actually quadrupled in value since the pandemic began, leaving long-term investors sitting pretty. So, what lies ahead for this pharmaceutical giant?

The Power of GLP-1 Drugs

GLP-1 receptor agonists like Wegovy and Ozempic are changing the game in obesity and diabetes treatment. These drugs work by mimicking the glucagon-like peptide-1 hormone, which not only helps control blood sugar levels but also reduces appetite. With obesity being a major health crisis—second only to smoking in terms of causes of death and disability—demand for these drugs is set to skyrocket.

Market Demand for Obesity and Diabetes Solutions

The statistics are staggering. By 2050, the number of people with diabetes globally is projected to soar from 529 million to 1.3 billion, a 46% increase while the world population grows by only 20%. In the U.S., diabetes rates are climbing particularly fast among younger populations, making the case for effective treatments more pressing than ever.

Expanding Applications of Semaglutide

Semaglutide, the active ingredient in both Wegovy and Ozempic, is not just limited to diabetes and weight management. Recent studies have uncovered additional benefits, such as significantly reducing the risk of cardiovascular events in diabetic patients. This expanding list of benefits only adds to the market’s optimism regarding semaglutide’s potential.

GLP-1 Drugs and Addiction Treatment

One of the most exciting developments involves the potential for GLP-1 drugs to help tackle addiction issues. A recent study highlighted that patients prescribed GLP-1 medications had significantly lower rates of opioid overdose and alcohol intoxication. This finding suggests that these drugs might play a pivotal role in addiction treatment, which could open up new revenue streams for Novo Nordisk.

Innovative Research Initiatives

Novo is also actively exploring new frontiers in drug development. They are researching a novel GLP-1 combination therapy aimed at treating alcohol use in patients with liver disease, alongside investigations into the drug’s potential for tackling degenerative diseases like Alzheimer’s. The versatility of GLP-1 drugs could mean a substantial expansion of Novo’s product offerings.

Also read: F1 São Paulo Shock: Norris on Pole, Verstappen Starts 17th

Comparing Novo Nordisk and Eli Lilly

In the competitive landscape of obesity treatments, Eli Lilly (LLY) has emerged as a formidable opponent. After launching its own obesity drug, Zepbound, sales have surged, surpassing half of Wegovy’s figures in just under a year. While Lilly’s stock jumped by 54% this year, Novo’s shares have taken a hit. However, don’t count Novo out just yet.

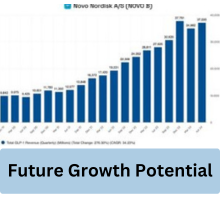

Future Growth Potential

Novo Nordisk has been proactive in securing its market position, making necessary investments to meet the growing demand for Wegovy. With trial results for its next-generation weight-loss drug, CagriSema, expected soon, there’s a palpable sense of excitement about what these findings could reveal. Analysts are optimistic that Novo could regain its footing in the market.

Valuation Insights

Currently, Novo shares are trading at about 28 times expected earnings, which is relatively attractive compared to Eli Lilly’s valuation. The price-to-earnings growth (PEG) ratio stands at 1.4, indicating that Novo is undervalued considering its growth potential. This valuation provides a compelling case for long-term investors looking to enter the stock at a favorable price.

Investment Recommendations

For those contemplating an investment in Novo Nordisk, now might be the perfect time. With the stock currently priced below $118, investors have a chance to buy at a discount, especially when considering the company’s long-term potential and ongoing innovations in drug development.

Also read: The Diplomat Season 2 Ending Explained by Keri Russell & Cahn

Conclusion

In summary, while Novo Nordisk has faced recent challenges, the long-term outlook for the company remains bright. With robust market demand for its GLP-1 drugs and ongoing research that expands their applications, there’s ample reason for investors to consider adding NVO to their portfolios. The current dip in stock price might just be the buying opportunity savvy investors have been waiting for.

FAQs

What is the significance of GLP-1 drugs?

GLP-1 drugs are vital for managing diabetes and obesity, helping to control blood sugar levels and reduce appetite.

How does Novo Nordisk compare to its competitors?

While Eli Lilly has seen recent success with its obesity drug Zepbound, Novo Nordisk remains a leader in the market with its established products Wegovy and Ozempic.

What are the future prospects for diabetes treatments?

With diabetes rates on the rise, the demand for effective treatments will continue to grow, making drugs like semaglutide increasingly important.

Why is the current valuation of Novo Nordisk attractive?

Novo shares are trading at lower multiples compared to competitors, indicating a potential undervaluation given the company’s growth prospects.

What should investors look for in upcoming trials?

Investors should pay attention to trial results for new therapies and combinations that could broaden Novo’s market reach and enhance its product lineup.